Technological Advancements Shaping the Hexamethylenediamine Industry

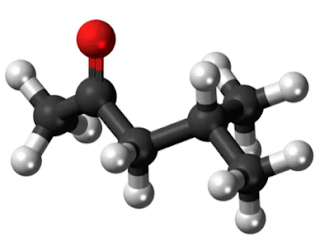

Hexamethylenediamine (HMDA) is a vital chemical compound with the formula C6H16N2, primarily used in the production of nylon and other polyamides. Its unique properties, including high reactivity and stability, make it an essential component in various industrial applications. The global hexamethylenediamine market size is projected to grow from USD 8.9 billion in 2022 to USD 11.6 billion by 2027, at a CAGR of 5.4% from 2022 to 2027. The organic compound with the formula H2N(CH2)6NH2 is known as hexamethylenediamine. A diamine is a molecule composed of a hexamethylene hydrocarbon chain terminated with amine functional groups.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=109635705

Key Uses of Hexamethylenediamine:

▶️ Nylon Production: The primary use of HMDA is in the manufacture of nylon 6,6, where it reacts with adipic acid to form the polyamide. Nylon 6,6 is renowned for its strength, durability, and resistance to heat and chemicals, making it ideal for:

- Automotive Parts: Used in manufacturing components such as radiator end tanks, air intake manifolds, and various under-the-hood parts due to its high thermal stability and mechanical strength.

- Textiles and Fibers: Essential in producing high-strength fibers for clothing, carpets, and industrial fabrics.

- Electronics: Utilized in the production of connectors, housings, and other electronic components that require high performance and durability.

▶️ Coatings and Adhesives: HMDA is used as a curing agent in epoxy coatings and adhesives, providing superior adhesion, chemical resistance, and mechanical properties, essential for applications in construction, aerospace, and marine industries.

▶️ Polyurethanes: It serves as a chain extender in the production of polyurethanes, which are used in foam products, elastomers, and coatings, contributing to their elasticity, durability, and resistance to wear and tear.

▶️ Chemical Intermediates: HMDA is a precursor in the synthesis of various chemicals, including hexamethylene diisocyanate (HDI), which is used in the production of high-performance polyurethane coatings.

Get Sample Copy of this Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=109635705

Hexamethylenediamine Market Growth and Demand in End-Use Industries:

✔️ Automotive Industry:

- Demand Drivers: The increasing production of lightweight, fuel-efficient vehicles is driving the demand for high-performance nylon 6,6. HMDA’s role in enhancing the thermal and mechanical properties of automotive parts is crucial.

- Growth Outlook: With the ongoing shift towards electric vehicles (EVs) and advancements in automotive technology, the demand for HMDA in this sector is expected to grow steadily.

✔️ Textiles and Apparel:

- Demand Drivers: Rising consumer demand for durable and high-quality fabrics, coupled with the growth of the athleisure and outdoor apparel markets, is boosting the need for nylon fibers.

- Growth Outlook: The textiles industry is projected to see sustained growth, especially in regions with expanding middle-class populations and increasing disposable incomes.

✔️ Construction and Infrastructure:

- Demand Drivers: The need for robust and long-lasting coatings and adhesives in construction projects, including residential, commercial, and infrastructure developments, is a significant demand driver.

- Growth Outlook: With urbanization and infrastructure development initiatives worldwide, the construction sector is expected to witness considerable growth, further fueling the demand for HMDA-based products.

Inquire Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=109635705

✔️ Electronics and Electrical:

- Demand Drivers: The miniaturization and increased functionality of electronic devices necessitate materials with superior performance characteristics, such as those provided by nylon 6,6.

- Growth Outlook: The electronics industry’s growth, driven by advancements in technology and increasing consumer demand for smart devices, is likely to enhance the demand for HMDA.

✔️ Aerospace and Marine:

- Demand Drivers: High-performance coatings and adhesives are essential in aerospace and marine applications for their durability, resistance to harsh environments, and superior bonding properties.

- Growth Outlook: Continued innovation and expansion in aerospace and marine industries will likely lead to increased utilization of HMDA in these sectors.

North America is the largest and fastest market for hexamethylenediamine

North America is expected to hold the largest share of the global hexamethylenediamine market in 2021. The United States and Mexico dominate the regional hexamethylenediamine market. The North American hexamethylenediamine market is expanding as a result of the regions expanding automotive industry. During the forecast period, the Asia-Pacific hexamethylenediamine market is expected to grow at the fastest CAGR.

A few of the key players in the hexamethylenediamine market are

🧪 BASF SE (Germany)

🧪 Merck KGaA (Germany)

🧪 TORAY INDUSTRIES, INC. (Japan)

🧪 Evonik (Germany)

🧪 DuPont de Nemours, Inc.(US)

Get 10% Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=109635705

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 HEXAMETHYLENEDIAMINE MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

FIGURE 2 HEXAMETHYLENEDIAMINE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 3 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 HEXAMETHYLENEDIAMINE MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 26)

FIGURE 7 NYLON SYNTHESIS APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 AUTOMOTIVE SEGMENT TO BE LEADING END-USE INDUSTRY OF HEXAMETHYLENEDIAMINE DURING FORECAST PERIOD

FIGURE 9 NORTH AMERICA LED HEXAMETHYLENEDIAMINE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 29)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN HEXAMETHYLENEDIAMINE MARKET

FIGURE 10 MARKET IN ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

4.2 HEXAMETHYLENEDIAMINE MARKET, BY REGION

FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4.3 NORTH AMERICAN HEXAMETHYLENEDIAMINE MARKET, BY APPLICATION AND COUNTRY (2021)

FIGURE 12 US AND NYLON SYNTHESIS SEGMENT ACCOUNTED FOR LARGEST SHARES

4.4 HEXAMETHYLENEDIAMINE MARKET: BY KEY COUNTRIES

FIGURE 13 MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 32)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HEXAMETHYLENEDIAMINE MARKET

5.2.1 DRIVERS

5.2.1.1 Extensive use in manufacturing nylon 66

5.2.1.2 Increasing demand for polyamides in 3D printing

5.2.2 RESTRAINTS

5.2.2.1 R&D to find replacement of hexamethylenediamine

5.2.2.2 Untapped growth potential in emerging economies

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of bio-based hexamethylenediamine

5.2.3.2 Growth opportunities in Asia Pacific

5.2.4 CHALLENGES

5.2.4.1 Slowdown in Chinese manufacturing sector

5.2.4.2 Environmental issues

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 HEXAMETHYLENEDIAMINE MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

FIGURE 2 HEXAMETHYLENEDIAMINE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 3 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 HEXAMETHYLENEDIAMINE MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 26)

FIGURE 7 NYLON SYNTHESIS APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 AUTOMOTIVE SEGMENT TO BE LEADING END-USE INDUSTRY OF HEXAMETHYLENEDIAMINE DURING FORECAST PERIOD

FIGURE 9 NORTH AMERICA LED HEXAMETHYLENEDIAMINE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 29)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN HEXAMETHYLENEDIAMINE MARKET

FIGURE 10 MARKET IN ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

4.2 HEXAMETHYLENEDIAMINE MARKET, BY REGION

FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4.3 NORTH AMERICAN HEXAMETHYLENEDIAMINE MARKET, BY APPLICATION AND COUNTRY (2021)

FIGURE 12 US AND NYLON SYNTHESIS SEGMENT ACCOUNTED FOR LARGEST SHARES

4.4 HEXAMETHYLENEDIAMINE MARKET: BY KEY COUNTRIES

FIGURE 13 MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 32)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HEXAMETHYLENEDIAMINE MARKET

5.2.1 DRIVERS

5.2.1.1 Extensive use in manufacturing nylon 66

5.2.1.2 Increasing demand for polyamides in 3D printing

5.2.2 RESTRAINTS

5.2.2.1 R&D to find replacement of hexamethylenediamine

5.2.2.2 Untapped growth potential in emerging economies

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of bio-based hexamethylenediamine

5.2.3.2 Growth opportunities in Asia Pacific

5.2.4 CHALLENGES

5.2.4.1 Slowdown in Chinese manufacturing sector

5.2.4.2 Environmental issues

Continued...

.png)

Comments

Post a Comment